When India’s Unified Payments Interface (UPI) went live in April 2016, few imagined it would completely change daily payments in less than a decade. Built by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI), UPI — together with simple, cheap QR codes — removed the friction of cash and card payments for millions of Indians. From tea stalls and street vendors to large retailers and government services, scanning a QR and confirming a payment on a phone has become the default way to pay. This long-form article explains how UPI works, why QR codes were the practical final piece, what changed between 2016 and 2025, and what merchants and consumers should know today.

Table of Contents

- UPI’s beginning: a short history and the who’s who

- Why QR codes mattered — the missing usability piece

- How a QR-based UPI payment works — the simple flow

- 2016 → 2025: the explosion of UPI transactions

- Real impact: how ordinary lives and small businesses changed

- Why QR-based payments beat alternatives for India

- Practical guide: how merchants can start accepting QR payments today

- The benefits for the economy — inclusion, traceability, and efficiency

- Challenges and things to watch

- The future: smarter QR experiences and broader inclusion

- Quick tips for users & merchants — best practices

- Conclusion

UPI’s beginning: a short history and the who’s who

The idea behind UPI was straightforward: build an interoperable, real-time bank-to-bank payment system that runs on mobile apps and uses simple identifiers (like VPAs — Virtual Payment Addresses) so users don’t need to exchange bank details. NPCI introduced UPI to the public with a pilot on 11 April 2016, followed by progressive rollouts through popular apps and bank partners. The platform operates on NPCI’s clearing infrastructure and falls under the regulatory oversight of the RBI. This combination of a sound technical rail (NPCI) and regulator backing (RBI) gave banks and fintechs confidence to build around UPI.

From day one, UPI aimed to be simple and ubiquitous: move money instantly between bank accounts using a smartphone, authenticate securely, and let any compliant app speak to the network. That technical promise is what made the system attractive to app developers (Google Pay, PhonePe, Paytm, BHIM, bank apps) and helped scale adoption rapidly.

Why QR codes mattered — the missing usability piece

UPI solved interoperability and settlement. QR codes solved real-world merchant usability. Unlike magnetic-card terminals and POS machines — which are expensive, require certification, and need maintenance — QR codes can be printed on paper, stuck on a phone screen, or shown on a cheap sticker. A vendor can accept payments with zero hardware cost beyond the simplest printout, and a buyer needs only a smartphone and any UPI-enabled app to scan and pay. That simplicity unlocked merchant acceptance across urban, semi-urban, and rural India. Initiatives like Bharat QR and app-native QR flows further standardized merchant acceptance and reduced fragmentation.

Put simply: UPI provided the rails; QR codes provided the doorway. Anyone could step through.

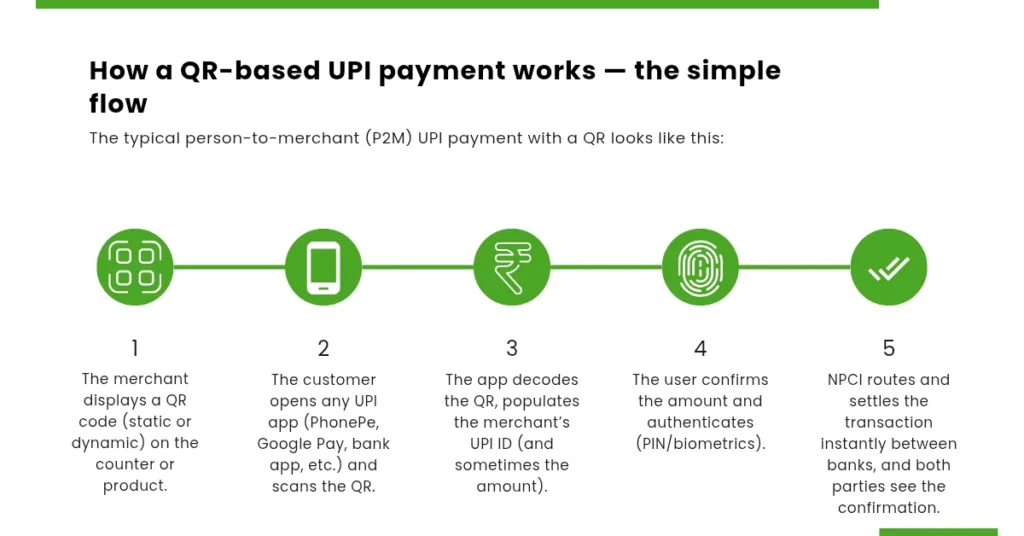

How a QR-based UPI payment works — the simple flow

The typical person-to-merchant (P2M) UPI payment with a QR looks like this:

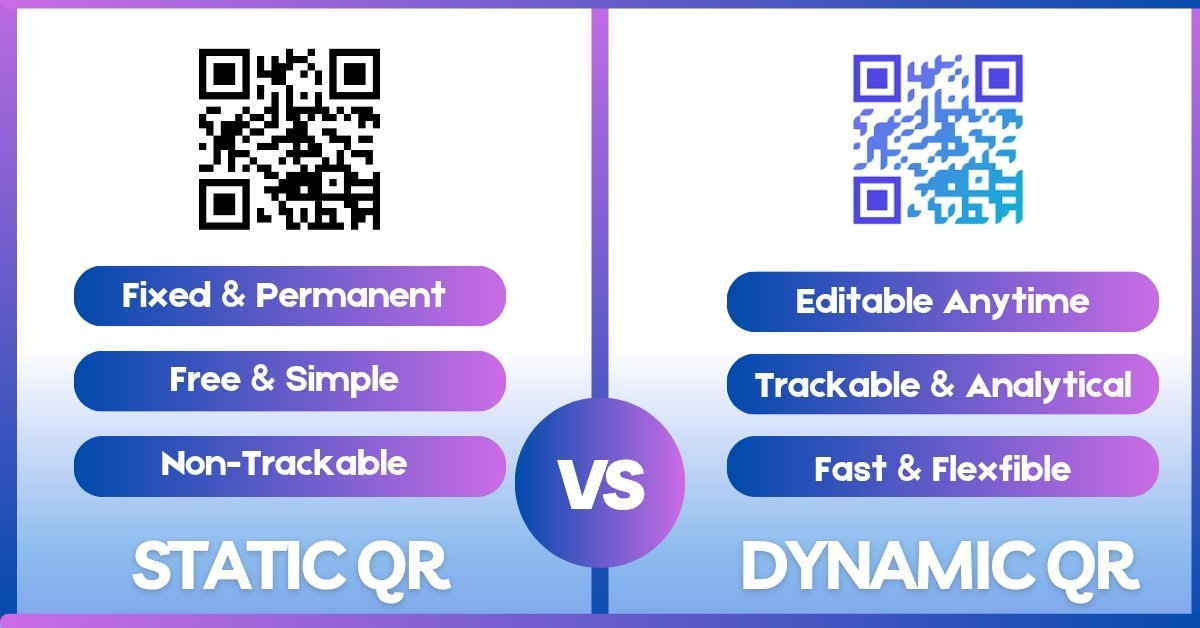

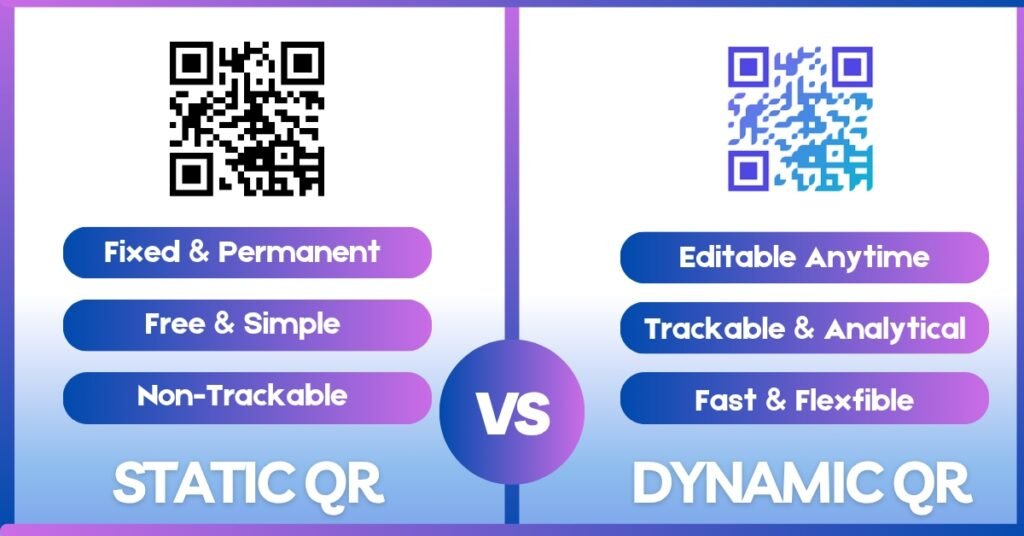

- The merchant displays a QR code (static or dynamic) on the counter or product.

- The customer opens any UPI app (PhonePe, Google Pay, bank app, etc.) and scans the QR.

- The app decodes the QR, populates the merchant’s UPI ID (and sometimes the amount).

- The user confirms the amount and authenticates (PIN/biometrics).

- NPCI routes and settles the transaction instantly between banks, and both parties see the confirmation.

If the QR is static, it encodes the merchant’s UPI ID or payment address; if it’s dynamic, the QR may contain a payment request with the exact amount and invoice data. The result is fast, low-friction payments with near-instant reconciliation on merchant apps. This flow is why a farmer’s market stall and a supermarket checkout can both use the same payment method.

2016 → 2025: the explosion of UPI transactions

UPI’s growth has been nothing short of meteoric. What started as a modest, pilot system in 2016 expanded into a national payments backbone within a few years. NPCI’s public metrics show enormous year-on-year growth in both transaction volumes and value — moving from millions of monthly transactions in the early years to billions per month in the mid-2020s. By 2024–2025, monthly UPI volumes routinely crossed into tens of billions of transactions, marking UPI as one of the world’s most-used real-time payment systems. These figures reflect not just urban adoption but strong penetration into smaller towns and neighborhoods, where QR acceptance has been critical.

That growth has a visible, human face: marketplaces in small towns, roadside vendors, tea shops, and local grocers now display QR codes; customers rarely reach for cash for everyday purchases. The psychology of carrying less cash, combined with convenient, interoperable apps, changed habits quickly.

Generate QR Code

“Generate Your Free QR Code Instantly – Customize, download, and share unlimited QR codes in PNG or SVG format. Fast, simple, and 100% free.

Real impact: how ordinary lives and small businesses changed

Here are tangible ways UPI + QR codes changed everyday life in India:

- Street vendors and micro-merchants: No more worries about change or counterfeit notes. A printed QR pasted on a stall converts any smartphone into a checkout terminal.

- Small businesses / kirana shops: Instant receipts and digital records improved bookkeeping and reduced cash management overhead.

- Consumers: Faster purchases, often without needing to open a bank app specifically — a universal QR flow does the job.

- Service providers & delivery: On-the-spot payments for deliveries or services became seamless; the delivery person or mechanic can accept payment without cash.

- Government & public utilities: UPI integrations for bill payments and government collections reduced leakage and simplified revenue tracking.

This tech democratization — cheap acceptance plus instant correction and refunds — is a big reason many Indians no longer feel the need to carry a wallet stuffed with notes for daily life. (For merchants who need to accept payments right away, generating a static UPI QR or creating dynamic invoices is all it takes.)

Why QR-based payments beat alternatives for India

There are several reasons India favored QR-driven UPI over other approaches:

- Low cost of acceptance: Printing a QR is near-zero cost; card terminals and POS devices are comparatively expensive.

- Interoperability: A single QR scanned by any UPI app works — no vendor lock-in.

- Ease of onboarding: Merchant onboarding for UPI acceptance is far quicker than acquiring a card merchant account.

- Speed and simplicity: Scan → confirm → pay is often faster than card swipe or cash counting for small-ticket purchases.

- Mobile-first population: With cheap smartphones and low-cost data, scanning-based payments fit naturally into user behavior.

The combination of these factors meant that not only were urban retailers quick to adopt, but even informal markets and remote vendors could join the digital payment ecosystem almost overnight.

Practical guide: how merchants can start accepting QR payments today

If you run a shop, stall, or online store and want to accept UPI payments with a QR code, here’s a simple checklist:

- Choose a UPI partner — sign up with a bank or payment provider that supports UPI merchant onboarding (many banks and fintechs provide quick sign-ups).

- Generate a merchant UPI ID — typically created during onboarding and used for reconciliation.

- Create a QR code — use a trusted QR code generator or the merchant dashboard provided by your bank. You can create a static QR (merchant ID) or generate dynamic QR invoices from your POS. At qrmyqr you can create attractive static QR codes for free and download them as PNG/SVG for print.

- Print and display — paste a laminated QR at the counter and keep an extra copy for delivery staff.

- Train staff — show a few quick examples: scan, check the merchant name, confirm amount, and enter UPI PIN.

- Reconcile daily — use the merchant dashboard to track incoming payments and confirm settlements.

For a small vendor, the marginal time to accept a digital payment is often less than counting cash and making change — a major productivity gain.

The benefits for the economy — inclusion, traceability, and efficiency

UPI’s wider adoption produced measurable macro benefits:

- Financial inclusion: Digital transactions give more people a trackable financial footprint, easing access to credit and formal services.

- Reduced cash leakage: Digital trails reduce informal losses and help small businesses keep better records.

- Faster settlements: Real-time settlement improves cash flow for MSMEs and reduces the friction of bank transfers.

- Lower transaction costs: For many small transactions, UPI is cheaper for both customers and merchants than card processing.

These systemic benefits explain why policymakers, banks, and fintechs promoted UPI and QR adoption aggressively. However, increased adoption also raised policy questions around fee structures and long-term economics — issues central to sustainable payments infrastructure. Recent discussions around merchant discount rates (MDR) for large merchants are examples of this policy debate.

Challenges and things to watch

No transformation is without friction. Key challenges include:

- Provider uptime & infrastructure: Dependence on servers and network connectivity means occasional outages can disrupt payments.

- Privacy and analytics: Dynamic QR services can collect scan analytics; merchants should be transparent about data use and consumers should be aware.

- Sustainability: As transaction volumes balloon, maintaining low-cost payment rails requires thoughtful cost allocation and possible fees for sustainability.

- Digital literacy & inclusion: Not everyone is comfortable with apps or PINs; continued education and offline-friendly flows (like UPI Lite) help bridge the gap.

The future: smarter QR experiences and broader inclusion

Expect the UPI + QR ecosystem to get smarter, not just bigger. Some trends to watch:

- Richer merchant experiences: QR codes that link to dynamic menus, loyalty programs, or multi-action pages (pay + claim coupon).

- Hybrid offline modes: Low-connectivity UPI flows and tokenization for offline scenarios.

- Interoperability beyond India: Cross-border QR standards and merchant interoperability with global wallets could expand the utility of the model.

- Sustainability models: Mechanisms to fairly compensate payment providers and keep the network healthy without burdening small merchants.

For web and tool builders like us at qrmyqr, the priority is clear: make QR code creation simple, reliable, and secure so any merchant can jump in with confidence.

Quick tips for users & merchants — best practices

- Always test a QR before printing — scan it with multiple apps.

- Use high-contrast designs so scanners can read codes reliably (dark code, light background).

- Prefer SVG for printing — vector formats scale without quality loss.

- Label the QR (merchant name/expected purpose) so users know where the code leads.

- Keep soft and hard copies — display a printed sticker and share a digital QR for deliveries.

If you want a quick, free QR to start accepting payments or display on your stall, try our free QR code generator at QRmyQR — create, customize and download in PNG or SVG with no sign-up. (Tip: generate a static UPI QR for permanent display, or use dynamic QR flows via your payment provider for invoices.)

Conclusion

The combination of UPI’s robust clearing rails and the humble QR code’s practicality catalyzed one of the world’s fastest transitions from cash-first to digital-first payments. From a pilot in April 2016 to billions of monthly transactions and near-universal merchant acceptance in the mid-2020s, India’s payments landscape was remade in a way that prioritized accessibility, affordability, and instant settlement. QR codes were the low-cost, high-impact tool that allowed millions of small merchants to accept digital payments overnight — and that is the heart of the “why” behind India’s move toward a near-cashless society.

If you’re a merchant or a curious consumer, start small: generate a free QR (PNG/SVG), test it, display it, and join the millions who’ve already embraced the simplicity of scan-and-pay.

Sources & further reading:

Here are the key references I used to support the information in the article, each with a usable URL:

References

- NPCI press release – UPI launch (11 April 2016)

https://www.npci.org.in/PDF/npci/press-releases/2016/UPI_Launch_Press_Release_April_11_2016.pdf - Investopedia explainer – What is UPI and how it works

https://www.investopedia.com/terms/u/unified-payment-interface-upi.asp - Razorpay blog – What is UPI and how it works

https://razorpay.com/blog/what-is-upi-and-how-it-works/ - Razorpay blog – What is Bharat QR and how it powers digital transactions

https://razorpay.com/blog/what-is-bharatqr-code-and-how-does-it-power-digital-transactions/ - World Bank – QR Codes in Payments (PDF)

https://fastpayments.worldbank.org/sites/default/files/2021-10/QR_Codes_in_Payments_Final.pdf - NPCI – UPI ecosystem product statistics

https://www.npci.org.in/what-we-do/upi/upi-ecosystem-statistics - Times of India – UPI transactions record (example)

https://timesofindia.indiatimes.com/business/india-business/upi-record-no-of-transactions-at-2k-crore-in-aug/articleshow/123644752.cms - IBEF – News report on UPI transactions surge

https://www.ibef.org/news/unified-payments-interface-upi-transactions-surge-in-2025-daily-average-value-crosses-rs-90-000-crore-us-10-3-billion-in-august-report - Grant Thornton India – India Payments Trends Report 2024 (PDF)

https://www.grantthornton.in/globalassets/1.-member-firms/india/assets/pdfs/newsletters/india-payments-trends-report-2024.pdf - Reuters – Policy discussions on merchant fees and homegrown payments

https://www.reuters.com/world/india/indian-authorities-keen-charge-merchants-fees-bolster-homegrown-payments-network-2025-04-29/ - BIS – QR codes in payments and financial inclusion (PDF)

https://www.bis.org/publ/bppdf/bispap152_e_rh.pdf